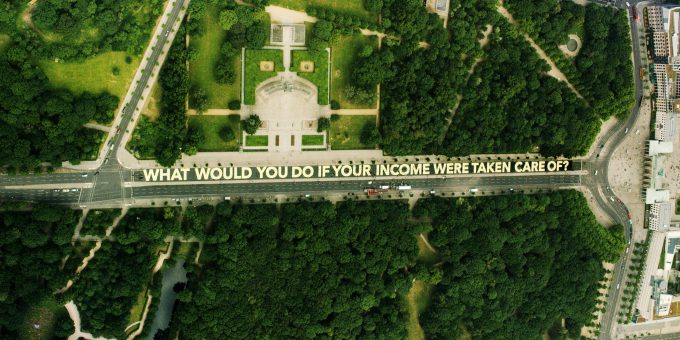

A 2016 demonstration in Germany asks a pertinent question in support of basic income policies. Generation Grundeinkommen

Disrupting the Racial Wealth Gap

Toxic levels of wealth inequality in the United States broke into public awareness on the heels of the Occupy Wall Street Movement in 2011. Some academics and social justice advocates had tried for years to elevate wealth inequality to the public square, but it took a social movement that started in Manhattan for people to take notice. Despite the movement’s focus on social class, race—the racial wealth gap, in particular—was notably absent as wealth inequality became a public conversation.

Understanding the profound intersections of race and wealth opens a window to our past, how advantage and disadvantage are passed along through family wealth, and how racial stratification is constructed and maintained. Historic wealth-amassing government policies, such as the Homestead Acts, Federal Housing Act, and the GI Bill, facilitated property ownership, homeownership, business development, and education largely for Whites, while systematically excluding similar opportunities for African Americans and other minority groups. The racial wealth gap is a result of both this historical legacy and enduring contemporary racial discrimination. As an indicator of racial inequality, framing a widening racial wealth gap against hard-won advances on the legal front provides a needed distinction between law and worsening material realities. Much discussion of what a racial justice filter might look like has been percolating, mostly in urban areas like Seattle, Oakland, Boston, Buffalo, and Tacoma.

Years of strategically and doggedly seeding the public discourse by advocates and researchers resulted in increasing attention to this “new” way of looking at racial inequality—examining the racial wealth gap. A breakthrough was symbolized by President Obama’s calling out the racial wealth gap as he spoke at the Lincoln Memorial on the 50th Anniversary of the March on Washington in 2013. Taking stock of the sweep of success and enduring challenges ahead, Obama stated: “Yes, there have been examples of success within Black America that would have been unimaginable a half-century ago. But as has already been noted, Black unemployment has remained almost twice as high as White employment [sic], Latino unemployment close behind. The gap in wealth between races has not lessened, it’s grown.”

We are firmly convinced that focusing on the racial wealth gap serves two critical functions: providing a scope for the extent and direction of racial inequality, a story on which path the nation is headed; and a reliable racial justice filter for policy and institutional practice.

Wealth Matters, Race Central

Wealth is the financial value of everything a family owns minus all debts, including home mortgages, credit card debt, and student loans. The most recent Survey of Consumer Finances (2016) reports that African-American families right in the middle possess a bit more than $17,000 in net wealth. Hispanic families right in the middle report close to $21,000 wealth. This includes wealth in home equity, which is by far the largest pot of wealth for about three-quarters of families, excluding wealthy families and those in poverty. Of course, many African-American and Hispanic families have nowhere near the median figures. Many have far less or no wealth. Many are in the red. With current monthly government poverty lines at $2,615 for a family of four, the dire straits even of typical families, much less those with little or no wealth, come quickly. An event like a government shutdown affecting wide swaths of federal workers might prove a household and family challenge for decades to come.

Contrary to African-American and Hispanic families, White families have amassed $171,000 in net wealth at the median. African-American families thus possess a dime for every dollar of White families’ wealth. Controlling for education, middle-class status, income, or occupation closes the racial wealth gap, but leaves major inequities in place.

The racial wealth data above provide a snapshot from a good representative sample. But they are only a slice at one point in time, leaving aside questions of family origin and family trajectory over time. Therefore, it is important to examine the same families, preferably over decades, to assess contemporary race and wealth dynamics. The Panel Study of Income Dynamics is positioned well for this task, as it started examining wealth in 1984 and has continually followed the same set of families and their wealth trajectories.

The figure above represents our analysis, starting with working-age families in 1984 and following them until 2015. In this sample, African-American family wealth is a rarely told and hardly recognized success story, starting at nearly $4,000 in 1984 and increasing to only $17,000 by 2015. The wealth of White families amasses from about $88,000 to $275,000 over the same period. That racial wealth gap, then, opened at $84,000 and tripled to $258,000. The reason for the racial wealth gap is a difficult one to condense, because it is about racialized structures that highlight connections between residual segregation, redlining, and housing equity; paid income from work, racialized occupational segregation, and access to, or lack of, workplace benefits like retirement plans, paid sick leave, and more; and the value of inheritance to anchor and further amass wealth for White families. The racial wealth gap definitely calls into question assumptions about the significance of Civil Rights legislation and affirmative action.

Over the years we have been doing this work, no one has ever questioned the authenticity of the numbers; what is constantly challenged is the narrative of what causes racial inequality. Roots of the racial wealth gap spread far beyond individual merit:

- The median White adult who attended college has 7.2 times more wealth than the median Black adult who attended college and 3.9 times more wealth than the median Latino adult who attended college.

- The median White single parent has 2.2 times more wealth than the median Black two-parent household and 1.9 times more wealth than the median Latino two-parent household.

- The median White household that includes a full-time worker has 7.6 times more wealth than the median Black household with a full-time worker and 5.4 times more wealth than the median Latino household with a full-time worker.

- Conspicuous consumption narratives fail because White households spend more than Black households with similar incomes, yet also have more wealth. Personal spending habits are not driving the racial wealth gap and cannot succeed in closing it.

Lack of education, family structure, hard work, and conspicuous consumption are not the main drivers of a widening racial wealth gap. While the narrative is contested, the entire body of this research ties the racial wealth gap to historical legacy, public policy, and institutional discrimination.

Our understanding of the widening racial wealth gap highlights how policy, deeply embedded racialized structures, and persistent discrimination intersect. The racial wealth gap was created over long periods of time dating back to slavery and continuing in different forms to this day. Clearly, then, large-scale transformations are needed to bend the arc just to keep a steady course on the road to equity and racial justice. Valuable policy ideas promise greater equity, but few resonate on the national policy landscape. In our estimation, massive campaigns and vibrant social movements will be required to move these ideas onto the national political and legislative agenda.

Four policy ideas have robust promise to reduce the racial wealth gap, if—and this is a huge “if”—they are designed and implemented in the most inclusive and robust fashion. Only a small number of policy ideas approach the disruptive and transformative goal of closing the racial wealth gap. We recognize that racial justice advocates understandably seek one simple “big fix”—a desire that has spurred the development of innovative policy ideas and created new infrastructures for wealth building. Massive racial wealth inequality did not result from a policy, but is itself a structure of historical and ongoing institutions and choices. Our experience is that there is no one solution. Instead, a broad suite of targeted policies must be pursued. The short list includes: Baby Bonds, Universal Basic Income, reducing or forgiving student debt, and a Federal Job Guarantee. None of these policies are currently in place. However, all are under serious consideration; some are even currently in the field in demonstration phases. We briefly discuss them and their potential for mobility and racial equity.Baby Bonds

We believe that Baby Bonds best capture both the conceptual spirit of equity and racial justice and potential effectiveness. In Review of Black Political Economy, economists Darrick Hamilton and William Darity propose giving every baby born in the U.S. between $500 and $50,000 on the day they’re born. Recently, Senator Cory Booker (D-NJ) proposed similar “Opportunity Accounts.”

The Baby Bonds proposal seeks to disrupt wealth inequality by leveling the playing field for the next generation. A bond between $500 and $50,000 would be adjusted for their family’s wealth. The average middle-class child would receive around $20,000. These bonds would remain locked until the child turned 18, when the funds would become available to pay for college, buy a home, or start a business. These Baby Bond accounts could reduce the racial wealth gap significantly. Had Baby Bonds been implemented a generation ago, for example, the Annie E. Casey Foundation’s 2016 analysis shows that the Black-White and Latino-White wealth gaps for 18- to 34-year-olds would have been entirely wiped out by now.

While a significant public investment, the Baby Bonds proposal starts to look pretty inexpensive weighed against the costs of massive and widening wealth inequality and dwindling social mobility. Since the Baby Bonds proposal scales according to wealth, it provides the biggest benefit for those who aren’t born into wealth. Some children are lucky enough to have key resources when they reach adulthood, largely due to their family’s wealth and inheritance, but others aren’t as lucky. The Baby Bonds proposal solves the “luck” problem by providing the same resource advantage to everyone when they turn 18. Given what we know about family wealth, its distributive equity impact is transformative.

Universal Basic Income

Universal Basic Income (UBI) has been receiving renewed interest, funding, pilots, organizational support, and media attention (see Calnitsky, this issue). In theory, at least, individuals would receive one-quarter of the national domestic product per capita, which in the United States translates to about $1,200 a month. This is marginally above the official poverty line for one person. Currently in the United States, Canada, and other countries, various UBI designs are being tested, typically none at the full UBI level. Stockton, California’s UBI has received the most coverage. That pilot program involves a small group of families receiving $500 a month for 18 months, with no strings attached. Advocates from various perspectives are enthusiastic about UBI’s impact on work narratives, poverty alleviation, remedy for automation and artificial intelligence, gender equality, and framing public wealth as its prime funding source. Sovereign wealth funds such as the Alaska Permanent Fund, which utilizes a slim part of the common wealth of oil revenues, are exemplars of common and public wealth. Skeptics focus on UBI’s drag on work and employment from les meilleurs casinos en ligne francais, inflationary impact, meager redistributive potential, and removing financial incentives to work.From our transformative perspective, UBI falls short in its framing tied to work, loss of work, and poorly paid work. The scheme falls on the labor and income side of the resource ledger, leaving the wealth component virtually untouched. In this way, UBI schemes need to be UBI Plus, with the Plus part highlighting wealth accumulation features. UBI may indeed be promising for a better standard of living, some income guarantees, and a degree of freedom from the cruelest bondages of the labor market. Current UBI designs, however, do not touch or impact wealth accumulation, wealth inequality, power relations, or the racial wealth gap. That is the extra mile that we suggest for the UBI movement. We are confident of the transformative opportunity to frame UBI in the context of reparative justice on wealth and race.

Reducing Student Debt

Outstanding student loan debt was mostly unchanged in mid-2018, standing at $1.41 trillion. According to the Federal Reserve Bank of New York, nearly 11% of aggregate student debt was over 90 days delinquent or in default, but this still likely underestimates the extent of newly delinquent student loans because many are in forbearance, deferment, or grace periods. Nationally, about two in three (65%) college seniors who graduated from public and private nonprofit colleges in 2017 had student loan debt, a slight decrease from 2016. These borrowers owed an average of $28,650, only slightly higher than 2016 graduates.

Data from the Survey of Household Economics and Decisionmaking (SHED) confirm that student loan debt differs along racial and ethnic lines. According to the Urban Institute, among 25- to 55-year-olds, 39.2% of Blacks, 30.5% of Whites, and 29.6% of Hispanics report having some type of student debt, either for their own education or relatives’. Among those with student loan debt, Blacks owe higher amounts of student loan debt (on average $43,725) than Whites ($31,367) or Hispanics ($30,741).

While bachelor’s degree recipients are typically better positioned than other students to repay their loans, certain groups of graduates still struggle with their debt. For example, graduates from lower income families are five times as likely to default on their loans as their higher income peers, with 21% of Black college graduates defaulting within 12 years of entering college. There remains an urgent need for federal and state policymakers to address the challenges of affordability and burdensome debt for all college students. However, many current proposals do not take race, family wealth, or income into account. Our research, reported in Less Debt, More Equity: Lowering Student Debt While Closing the Black-White Wealth Gap, shows that targeted policies that lower student debt levels for families with fewer financial means would steer scarce public resources to those with financial need as well as lower the racial wealth gap.

Federal Job Guarantee

A Federal Job Guarantee (FJG) recommends a set of bold policies aimed at full employment and ending poverty. This is achieved through providing universal job coverage for all adults so as to eliminate involuntary unemployment. FJG proposals intend to eliminate poverty wages by establishing a minimum annual wage indexed for inflation for full-time workers above the poverty line for a family of four. Proposals, as outlined in a 2018 brief from the Center on Budget and Policy Priorities, account for regional variation and for wage advancement. The impact is not only to guarantee employment to anybody who wants to work at a paid job, it also frees up workers to search for higher paying and more satisfying work. That feature further motivates employers to build a workplace culture that retains satisfied workers.

A critical feature of some FJG proposals is the inclusion of benefits. FJG centers on paychecks, full employment, and ending poverty—all of which are income-based labor market ideas. Thus, the inclusion of benefits that crosswalk income to wealth protections and wealth accumulation forwards these proposals past labor market limitations. Specifically, health insurance, paid sick leave, maternity/paternity leave, paid vacation time, and retirement plans are benefits that protect wealth while building it. A high degree of occupational segregation maps to occupations and economic sectors offering (and not offering) workplace-based benefits. Robust FJG proposals incorporating healthy benefit packages extend much-needed protections and target workers of color most often concentrated in lower paying occupations without access to workplace-based benefits. These kinds of policy features commend FJG as one solution to the racial wealth gap.

In closing, a brief examination of potentially disruptive, transformative policy ideas moves us closer on how to link economic equality and racial justice to social mobility and poverty alleviation. Racial equity needs to be our North Star, pursued within policies regarding individual, family, or community social mobility.

Recommended Resources

Annie E. Casey Foundation. 2016. “Investing in Tomorrow: Helping Families Build Savings and Assets.” Baseline primer, data, and policy ideas addressing the racial wealth gap.

Breno Braga. 2016. “Racial and Ethnic Difference in Family Student Loan Debt,” Urban Institute. Data and analysis documenting racial difference in the prevalence of and amount of student loan debt.

Federal Reserve Bank of New York. 2018. “Quarterly Report on Household Debt and Credit 2018: Q2.” Official (government) source for data on amount and sources of rising household debt.

Darrick Hamilton and William A. Darity, Jr. 2010. “Can ‘Baby Bonds’ Eliminate the Racial Wealth Gap in Putative Post-Racial America?” Review of Black Political Economy 37(3-4). Policy description and features of Baby Bonds, the basis for Senator Booker’s policy proposal.

Mark Heulsman, Tamara Draut, Tatjana Meschede, Lars Dietrich, Thomas Shapiro, and Laura Sullivan. Less Debt, More Equity: Lowering Student Debt While Closing the Black-White Wealth Gap. Models student debt reduction policy options, showing that a progressive student debt reduction policy would dramatically reduce the racial wealth gap among low-wealth households.

Mark Paul, William A. Darity, Jr., and Darrick Hamilton. 2018. “Federal Job Guarantee—A Policy to Achieve Permanent Full Employment.” Center on Budget and Policy Priorities. Basic policy description, analysis, and case for a federal job guarantee, highlighting policy features that enhance equity.