Tax Myths

Tax paradoxes abound.

Taxation is a vital component of government policy, yet most citizens profess little understanding of the tax system. Many Americans wish taxes were lower, but they want to maintain or expand most of the government programs taxes fund. Policymakers regularly pledge to simplify the tax code, yet it grows ever more complicated.

Tax myths are equally common. In recent years, social scientists have devoted greater attention to empirical study of taxes—how they operate, what effects they have, how the public perceives them. As it turns out, a number of things—four in particular—citizens and policymakers think they know about taxation are wrong.

myth #1: heavy taxation reduces economic competitiveness

Taxes distort the market’s ability to allocate resources toward their most productive use, and textbook economic theory tells us this is bad for the economy. Taxation may be necessary to fund government services and redistribution of wealth and resources in a way that conforms to the needs and norms of a modern society, but it’s a necessary evil.

But do taxes really harm the economy? And if so, how much?

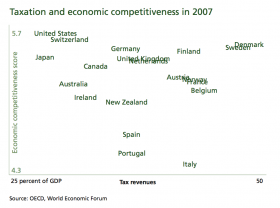

One way to think about this is in terms of economic competitiveness. In recent years the World Economic Forum has scored most of the world’s countries on a competitiveness index that aims to assess the quality of nine components of a nation’s economy: public and private institutions, infrastructure, macro-economic policy, health and primary education, higher education and training, market efficiency, technological readiness, business sophistication, and innovation. The scores range from a low of 1 to a high of 7.

As the chart (right) suggests, as of 2007, the most recent year with available data, there’s no association across the world’s affluent countries between the level of taxation—the share of economic output (gross domestic product, or GDP) that passes through the government as taxes– and competitiveness.

As the chart (right) suggests, as of 2007, the most recent year with available data, there’s no association across the world’s affluent countries between the level of taxation—the share of economic output (gross domestic product, or GDP) that passes through the government as taxes– and competitiveness.

How can this be? One hypothesis, suggested by economic historian Peter Lindert in his book Growing Public, is that high-tax countries such as Sweden, Denmark, and Finland rely heavily on consumption taxes, the burden of which is shared broadly across the citizenry rather than concentrated on firms and affluent individuals. Other analysts, though, contend that heavy consumption taxes weaken the economy, especially job creation, by raising the price of goods and services.

An alternative view is that the effect of taxation on economic health depends not on the level or type of taxation but instead on how tax revenues are used. Sociologist Gøsta Esping-Andersen has pointed out that at least some of the hightax nations shown below devote a significant share of their revenues to providing public services and transfers—Social Security, Medicare and Medicaid, unemployment compensation, the Earned Income Tax Credit, Temporary Assistance to Needy Families, and food stamps, among others—that tend to boost, rather than impede, economic competitiveness.

For example, a schooling system that begins with affordable and high-quality child care (“early education”), includes good general education through high school for even the poorest, and offers broad access to university education is likely to facilitate innovation and flexibility in a globalized, knowledge-based economy. As well, universal access to health care and generous transfers to low-earning households improve the chances of building strong cognitive and social skills throughout the population. Government-provided or -subsidized child care and parental leave encourage women’s employment, thereby boosting the economy’s supply of ideas and creativity.

These are just some of the ways effective use of tax revenues can help offset whatever negative impact taxes may have on economic performance.

Heavy taxation certainly doesn’t ensure a competitive economy, but it appears to be perfectly compatible with one.

myth #2: republicans favor tax cuts because they believe they’re good for the economy and key constituents

“The one thing that unites Republicans from Maine to Mississippi,” Mitch McConnell, the current Republican leader in the Senate, told National Public Radio in January, “is tax cuts.”

He’s right. And it’s been true for nearly three decades.

One reason why this may be true is many Republicans believe less taxation is good for the economy. Another is that tax reductions appeal to two of the party’s core constituencies: businesses and people with high incomes. Both of these explanations have merit, but in his recent book The Permanent Tax Revolt, sociologist Isaac Martin offers an equally, if not more, compelling account.

It comes down to, Martin says, the legacy of Proposition 13’s passage in California in 1978, similar victorious initiatives in other states, Ronald Reagan’s presidential victories in 1980 and 1984, and the Reagan tax cuts of 1981.

Proposition 13 was a California referendum that restricted property tax increases. Movements for state and local property tax limits had existed for a number of years, but prior to the late 1970s they had enjoyed limited popularity and virtually no ballot success. The victory of Proposition 13, itself a product of a peculiar conjunction of circumstances, provided credibility and political momentum to the cause in other states and led to Reagan’s conversion to tax cuts as a political strategy. Not long after there were several additional property tax cap wins at the state level in addition to Reagan’s two election triumphs. In 1981, the Reagan administration successfully pushed a major tax reform, which included sharp reductions in income tax rates, through Congress.

These successes shaped the thinking of a new generation of Republican leaders, advisors, and voters. For many, they created an image of the modern Republican party as the party of tax cuts. Just as a generation of Democrats identified theirs as the party of the New Deal following Franklin D. Roosevelt’s success and popularity in the 1930s and early 1940s, tax cuts became the core element of the political culture of the post1980 generation of Republicans.

Moreover, for many Republicans the lesson of the late 1970s and early 1980s was that advocating tax reductions is the key to electoral success. Reversals by two key Republican presidential candidates in subsequent years are illustrative.

During the 1980 Republican primary, George H.W. Bush ridiculed Reagan’s tax-cut proposals as “voodoo economics.” Reagan won the primary and was then victorious in two presidential elections, continuing with his tax-cutting pledge throughout. When again campaigning for president in 1988,

Bush switched his position—his mantra became “no new taxes,” even though the federal government’s debt had risen sharply during the eight years of Reagan’s presidency.

This story replayed two decades later with Sen. John McCain. In the early 2000s, McCain criticized president George W. Bush’s proposed tax cuts as fiscally irresponsible. When running for president in 2008, however, McCain switched his stance and argued forcefully for further tax reductions, despite evidence that the tax cuts of the 1980s and 2000s had contributed to sizable budget deficits. The circumstances of these turnabouts suggest that both Bush and McCain were swayed mainly by a belief that tax cuts bring electoral victory, I would argue.

Republican candidates’ and politicians’ emphasis on tax cuts since the late 1970s has put taxes front and center in American political discourse. This is a marked change compared to earlier decades when taxes were much less prominent in political debate.

Using survey data going back to the 1940s, political scientist Andrea Louise Campbell has found that as politicians have devoted greater attention to taxation, public dissatisfaction with income taxes has tracked actual taxation levels much more closely than in the 1940s, 1950s, and 1960s. As a result, Campbell argues, when policymakers raise income tax rates, they’re more likely now to encounter opposition not only from Republicans but from the citizenry as a whole. Though this doesn’t render tax increases impossible, it surely makes them less likely.

myth #3: taxes reduce inequality

A good bit of the political debate about tax policy in the United States has to do with the tax system’s progressivity—the degree to which it reduces income inequality. Most citizens and policymakers assume the tax system is progressive. Conservatives often think it’s too progressive, while many liberals think it isn’t progressive enough.

Taxes do help reduce income inequality, but not in the way many people think.

The U.S. tax system as a whole is essentially flat, rather than progressive. Individuals and households throughout the income distribution pay approximately the same share of their market incomes—earnings and other non-government sources such as investments, gifts from friends, alimony, and so on—in taxes. How can that be, when tax rates on income are higher for those with higher incomes?

The U.S. tax system as a whole is essentially flat, rather than progressive. Individuals and households throughout the income distribution pay approximately the same share of their market incomes—earnings and other non-government sources such as investments, gifts from friends, alimony, and so on—in taxes. How can that be, when tax rates on income are higher for those with higher incomes?

Income taxes are indeed progressive, but that’s offset by regressive payroll and consumption taxes. Payroll taxes, which fund Social Security and Medicare, are levied at a flat rate (7.65 percent) regardless of how much one earns. But earnings above a certain amount ($102,000 as of 2008) are exempt from the payroll tax, so the portion of earnings taxed is larger for low and middle earners than for high earners. Consumption is taxed via state and local sales taxes. These too are a flat rate, usually in the neighborhood of 4 percent to 8 percent. Yet, because those with lower incomes by necessity spend (rather than save) more of their incomes, a larger portion of their incomes is subject to consumption taxes.

In a report by the non-partisan educational nonprofit Tax Foundation, economists Andrew Chamberlain and Gerald Prante estimated the share of market incomes that each segment of the population paid in taxes to federal, state, and local governments in 2004. They divided households into five equally sized groups (called quintiles) based on their market income. The effective tax rate is roughly the same throughout the income distribution: households in the poorest quintile paid, on average, 31 percent of their market income in taxes, each of the next three quintiles paid approximately 28 percent, and the highest-income quintile paid 30 percent. Contrary to widespread opinion, then, taxes accomplish very little, if any, reduction of inequality.

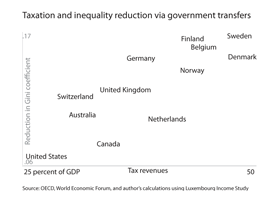

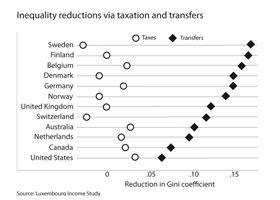

This doesn’t mean there’s no redistributive effect of government policy. It simply tells us that taxes aren’t the locus of redistribution. Instead, transfers are. Far more poor than rich receive cash and noncash government transfers.

The United States isn’t exceptional in this regard. Transfers do most of the redistributive work in rich countries. The chart at left illustrates this, showing the degree to which income inequality is reduced by taxes and government transfers in 12 countries. Larger numbers indicate greater reduction of inequality. In most of the countries, virtually all income redistribution occurs via transfers. Taxes do little or nothing to reduce income inequality, and in several countries they increase it.

The United States isn’t exceptional in this regard. Transfers do most of the redistributive work in rich countries. The chart at left illustrates this, showing the degree to which income inequality is reduced by taxes and government transfers in 12 countries. Larger numbers indicate greater reduction of inequality. In most of the countries, virtually all income redistribution occurs via transfers. Taxes do little or nothing to reduce income inequality, and in several countries they increase it.

Actually, these data overstate the degree of inequality reduction accomplished via taxes, because consumption taxes, which are always regressive, aren’t included. Sociologists Monica Prasad and Yingying Deng have attempted to incorporate consumption taxes into calculations of tax progressivity. They’ve found that in the 1990s and 2000s none of the eight countries for which a calculation is possible have had a progressive tax system. All have been regressive.

However, taxes do play a vital role in reducing inequality. They fund the transfers and services that do the redistributive work. The chart above highlights a finding from my own research: countries that achieve more redistribution via transfers are able to do so because they collect more tax revenues. (The redistributive effect of services is very difficult to measure.) In other words, taxes are quite important for inequality reduction, but what matters most is their quantity rather than their progressivity.

myth #4: globalization makes heavy taxation impossible

Over the past two decades, a number of policymakers and social scientists have predicted that globalization and capital mobility would engender a “race to the bottom” in taxation. With firms and investors free to move to whatever country offers the lowest tax rates, governments have a strong incentive to reduce taxation in order to gain a competitive advantage. Others are then forced to follow suit.

This assumption is a perfectly reasonable one. Yet so far it’s proved largely wrong.

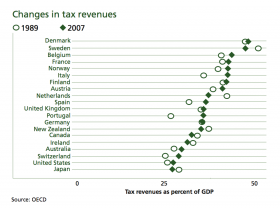

Governments indeed feel heightened pressure to reduce tax rates, but while most countries have lowered statutory tax rates on investment income and corporate profits, such reductions have been mostly or fully offset by scaling back tax exemptions and deductions and, in some countries, by increasing the rates for other types of taxes, such as those on consumption and payroll.

Governments indeed feel heightened pressure to reduce tax rates, but while most countries have lowered statutory tax rates on investment income and corporate profits, such reductions have been mostly or fully offset by scaling back tax exemptions and deductions and, in some countries, by increasing the rates for other types of taxes, such as those on consumption and payroll.

The result has been little change in tax revenues as a share of GDP, as the chart above indicates. It shows tax revenue levels in 1989 and 2007 in 20 nations (both years are business cycle peaks, so it’s fair to compare them). In a few countries tax revenues decreased, but in others they increased. In most they stayed more or less the same.

Why no decline? Various hypotheses have been offered. A particularly compelling one is suggested by sociologist John Campbell, who points out that domestic institutions shape both the perceived interests of economists and politicians in the face of globalization pressures and their ability to pursue those interests. He writes:

Where labor is well-organized and politically influential, unions and their political supporters are willing to support relatively high taxes because they expect it will help finance the programs from which they benefit. Similarly, where business is well organized, such as through business associations, firms tends to see that relatively high taxes support programs (health insurance, education, and research and development) that ensure social peace and help them remain competitive internationally.

Moreover, the manner in which politics is arranged institutionally affects tax policymaking. Countries with inclusive policymaking institutions, such as corporatism or electoral systems that yield coalition governments, tend to be less inclined to race toward the bottom because these institutional arrangements encourage compromises that mitigate such behavior.

Despite very real pressures favoring lower taxation, we therefore observe little or no movement toward a reduction of revenues in high-tax nations.

The stability of tax levels over the past few decades doesn’t, of course, guarantee they won’t fall in the future. But it does suggest heavy taxation is feasible in a globalized economy.

Taxation is an integral component of a modern economy. But it’s complicated and operates much differently than most conventional assumptions and theorizing would have it. A better understanding of these realities not only makes manifest the necessity, it could lead to better, more informed fiscal policies.

recommended resources

Andrea Louise Campbell. “What Americans Think of Taxes,” in The New Fiscal Sociology: Taxation in Comparative and Historical Perspective (Cambridge University Press, 2009). Examines U.S. public opinion on taxes from 1940 to the present.

John L. Campbell. “Fiscal Sociology in an Age of Globalization: Comparing Tax Regimes in Advanced Capitalist Countries,” in The Economic Sociology of Capitalism (Princeton University Press, 2005). Assesses the notion that economic globalization forces countries to reduce tax rates.

Gøsta Esping-Andersen. “Equal Opportunities and the Welfare State,” Contexts (2007) 6(3): 23-27. Highlights how government investment in cognitive and noncognitive skill development expands opportunity.

Isaac William Martin. The Permanent Tax Revolt (Stanford University Press, 2008). Explores the causes and consequences of the property tax revolt of the 1970s.

Monica Prasad and Yingying Deng. “Taxation and the Worlds of Welfare,” Socio-Economic Review online release in April 2009. Analyzes the progressivity of various types of taxes in rich countries.

Online Resources

Listen to Lane Kenworthy on the Contexts Podcast

Comments 3

Lane Kenworthy on Tax Myths | The Global Sociology Blog

July 31, 2009[...] Tax Myths » Contexts via kwout [...]

check out contexts summer 2009!!! « orgtheory.net

August 16, 2009[...] Lane Kenworthy discusses popular misconceptions about taxation. [...]

zcato

May 6, 2010This was an amazing insight into common beliefs about taxation. I found myself surprised at how the beliefs I had about taxes proven false, and how so many of these beliefs are perpetuated by the world around me. Many citizens are so stuck in a rut about the tax systems that they don't really understand that we aren't able to make effective changes. We all love to live in nice communities, but there's some belief out there that we don't have to pay taxes to do it. I'm not going to pretend that I've understood more than 65% of what's written here, but if more people knew more about the truth of taxes, we might be able to pay for schools and nice streets, assuming we can't ever get out of this pointless war.