Golden Years? Poverty Among Older Americans

In the wake of the Bernard Madoff investment scandal, the television news broadcast heart-wrenching images of devastated older adults—many living in the tony enclaves of West Palm Beach, Florida—whose fortunes had evaporated in Madoff’s Ponzi scheme.

Although few of the victimized retirees are indigent, their declining fortunes did cast the spotlight on a social issue that has been largely neglected over the past several decades: the economic well-being of older adults.

The economic standing—and poverty levels, more specifically—of Americans ages 65 and older has fallen off the national radar, replaced by widespread concerns over child poverty. A quick look at historical data might lead the casual observer to conclude that this shift in focus is justified. Elderly poverty rates declined sharply from 35 percent in 1959 to 15 percent by the 1970s. The proportion of older persons living in poverty has wavered between 10 and 12.5 percent since the 1980s. Child poverty rates, by contrast, climbed through the 1960s and 1970s, surpassed elderly poverty rates in 1974, and have fluctuated between 17 and 20 percent ever since.

Click a thumbnail for a slideshow

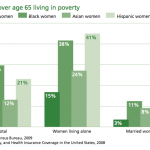

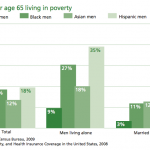

But the decline and stabilization of overall poverty rates among older adults reveals an incomplete portrait of late-life poverty. Poverty rates among older adults range from just 3.1 percent among white married men to an astounding 37.5 percent for black women who live alone and 40.5 percent for Hispanic women living alone. In other words, older women of color who live alone are more than ten times as likely as their white married male counterparts to be poor. Moreover, recent research by the National Academy of Sciences suggests that overall poverty rates among older adults may be severely underestimated because the current measure fails to consider the high (and rising) costs of medical care, which disproportionately strike older adults.

How can we make sense of the fact that overall elderly poverty levels have dropped precipitously over the past four decades, while some subgroups of older adults remain at great risk of impoverishment? The overall declines in elderly poverty rates are due to Social Security benefits, which remain the nation’s largest social welfare program. The Social Security Act was signed by President Franklin D. Roosevelt in 1935 as part of the New Deal. The intention was to provide “social insurance,” or income protection, for older adults. During the program’s first three decades, though, its benefits barely provided a minimum standard of living because monthly payments were not adjusted annually to offset inflation.

The first-ever beneficiary of Social Security, retired legal secretary Ida May Fuller, received a benefit of $22.54 in January 1940, and her monthly checks remained at that amount for more than a decade. In 1950, benefits were raised for the first time. In 1972, Congress enacted a law that allowed for annual and automatic Cost of Living Adjustments (COLAs). The current average monthly payment is $1,094. Economists estimate that without Social Security, the 2008 elderly poverty rate would be 40—rather than 9.4—percent.

Given these advances, why do poverty levels remain higher among women, especially unmarried women and persons of color? Experts point to three main explanations. First, most women have had lower paying jobs, more sporadic employment, and more part-time work over the life course than their male counterparts. Because of stark gender differences in life-time earnings (on which Social Security benefits are based), women’s own benefits are lower than those of their male peers. (Housework and childcare are unpaid activities and thus are not directly calculated into benefits levels.) Given the “double jeopardy” of being a woman and an ethnic minority in the labor market, benefits are typically lower for blacks and Latinos than for whites, thus the particularly disadvantaged state of older women of color.

Second, women (and especially women of color) are less likely than men to receive private pensions. This is due to women’s more discontinuous work histories and their tendency to work part-time or in occupations providing few benefits. This pattern contributes to late life poverty because private pension benefits are an important supplement to monthly Social Security benefits. While roughly one-third of older men receive a private pension, only 18 percent of women do so. Among those who receive a pension, men’s pensions are nearly twice the size of women’s. In 2000, the median private pension or annuity income for older women was $4,100 compared to men’s $7,800.

Finally, women who have lost a husband to death forsake his employment income if he is working at the time of death or his pension income if he is retired at the time of death. Widows also must pay high end-of-life medical expenses and funeral bills that can overwhelm their already low income and savings. Further, married couples tend to underestimate the number of years that a widow will outlive her husband, so they may not plan their savings and investments accordingly. As a result, older widowed women, especially those who faced economic disadvantages earlier in life, are at an elevated risk of late-life poverty relative to their married male counterparts.

Despite tremendous improvements in overall economic well-being among older adults during the past half-century, the future looks bleak—at least for some elders. Some experts argue that the current government indicator of poverty does not adequately capture the economic realities of late life. The National Academy of Sciences has proposed a new calculation that takes into account rising health care costs. Under this new formula, the proportion of older adults living in poverty would double from just over 9 percent to 18.6 percent. (By contrast, the overall U.S. poverty rate would increase only slightly from 12.5 to 15.3 percent).

To compound matters, for the first time since 1975, Social Security recipients won’t get an automatic cost of living increase in their benefits in 2010. Increases are tied to inflation, and inflation was negative in 2009. To offset the flat payments, President Barack Obama vowed to send all seniors a one-time $250 payment. However, this payment may be little consolation to those older adults with declining assets and investment income due to the collapse of the housing bubble, failed investments, and falling stock prices. Fortunate older adults may find their retirement years to be “golden,” while others may need to continue working far past age 65 just to maintain a minimum standard of living.

Comments 2

Obama to base: if you were serious in ’08, now’s the time to ‘step up’ : The Reid Report

September 28, 2010[...] more bonuses for themselves while plunging millions of elderly into the kind of poverty that was commonplace before the New Deal, and which, because of Social Security, has fallen by more than two thirds [...]

Back to the Commune, Part Two « Weekly Update on Aging

October 30, 2011[...] Carr, Deborah. Golden Years? Poverty Among Older Americans. Contexts, American Sociological Association, Winter 2010. http://contexts.org/articles/winter-2010/golden-years-poverty-among-older-americans [...]